What are Digital Arrest Scams? | How do Digital Arrest Scams Work? | Common Red Flags | What Are Family Emergency Scams? | How does Voice Cloning Enable Family Scams? | What Technology is used in Digital Arrest Scams? | Why India is a Targeted Market? | Real-World Impact | Preventive Measures: How to Protect Yourself | Reporting Scams: Legal and Regulatory Framework | Conclusion | FAQs for Digital Arrest Scams

What are Digital Arrest Scams?

Digital arrest scams are frauds where scammers impersonate law enforcement officials to falsely accuse victims of crimes and coerce money transfers under threat of arrest. These scams often include fake arrest warrants, deepfake videos, and staged “police” setups over video calls to convince the victim they’re under a fabricated “digital arrest.”

In recent years, India has witnessed a surge in sophisticated phone-based frauds, particularly Digital Arrest Scams and Family Emergency Scams. These schemes prey on fear, urgency, and a lack of digital literacy to extort money from unsuspecting victims. This comprehensive guide unpacks how these scams operate, highlights the red flags to watch out for, and provides actionable steps to protect yourself and your loved ones. By the end of this article, you’ll have a clear understanding of:

- The modus operandi of each scam.

- Key warning signs that indicate fraud.

- Practical preventive measures and recourse.

Read More: What is Meta’s Accounts Center? How Does it Work, Security Risks, and How to Secure Your Account

Whether you’re a tech-savvy millennial or a senior citizen, this guide offers authoritative, up-to-date insights to safeguard against evolving tactics.

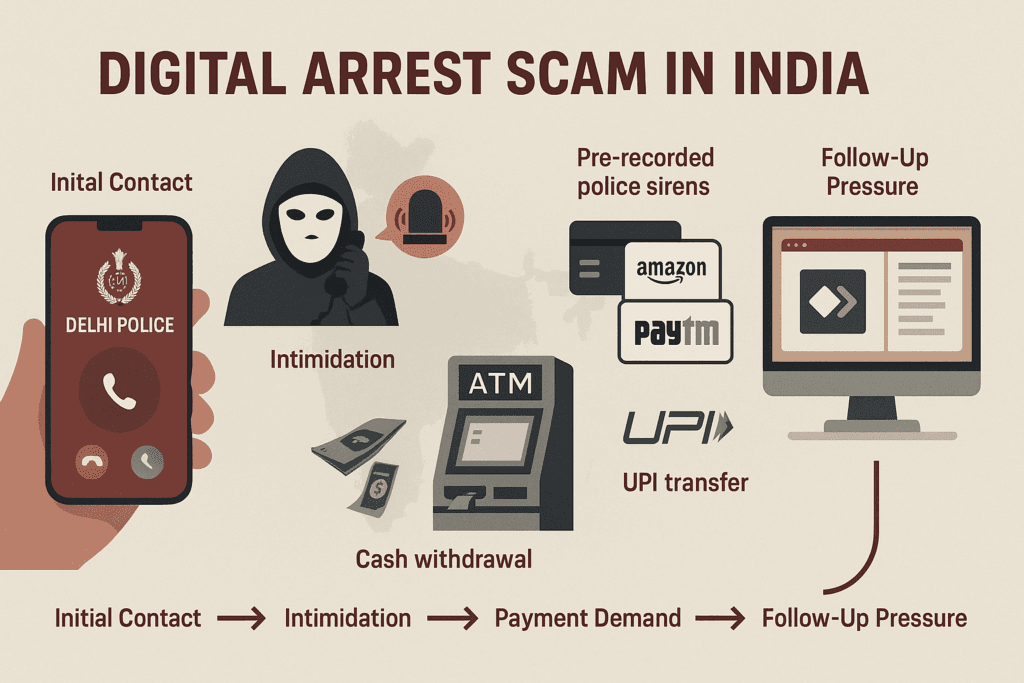

How do Digital Arrest Scams Work?

- Initial Contact

- The caller uses a spoofed police or government phone number.

- They inform the victim that their Aadhaar, PAN, or bank account details have been implicated in an ongoing investigation.

- They instruct the victim to remain calm and cooperate—or risk immediate arrest.

- Intimidation Tactics

- Threats of police raids or garnished assets if the victim doesn’t comply.

- Use of technical jargon (“IFRS violations,” “interpol watchlist”) to appear legitimate.

- Pre-recorded background noises of police operations to add credibility.

- Demand for Payment

- The scammer insists the victim must transfer a large sum (often ₹50,000–₹200,000) to a “safe” account to clear their name.

- They may ask the victim to withdraw cash from bank ATMs, load it onto gift cards (e.g., Amazon Pay, Paytm), or transfer funds via UPI to a third-party account.

- In some variations, they install remote desktop software (e.g., TeamViewer, AnyDesk) to “verify” documents on the victim’s computer.

- Follow-Up Pressure

- If the victim hesitates, the scammer escalates threats: jail time, asset seizure, or blacklisting.

- In more elaborate setups, a “supervisor” calls to reassert authority, mimicking layered hierarchy.

Read More: WhatsApp Job Scams in 2025: How to Spot Fake Offers, Protect Yourself, and Find Legit Online Work

External Reference: For official alerts and guidelines, refer to the Ministry of Home Affairs: Cyber Crime Prevention.

Common Red Flags

- Spoofed Caller IDs: Scammers fake official numbers (e.g., +91-011-2396xxxx).

- Urgent Threats: If you don’t pay ₹100,000 by tonight, we’ll arrest you at your doorstep.

- Requests for Untraceable Payments: Gift cards, UPI to unknown accounts, or cryptocurrency.

- Remote Access Demands: Download AnyDesk to verify your bank statements.

- No Formal Documentation: Absence of official letters, emails, or legal notices—everything is verbal.

What Are Family Emergency Scams?

A family emergency scam is a con where scammers impersonate relatives in distress—often using AI voice cloning—to trick victims into sending money urgently. These scenarios include fake kidnappings, arrests, or medical emergencies.

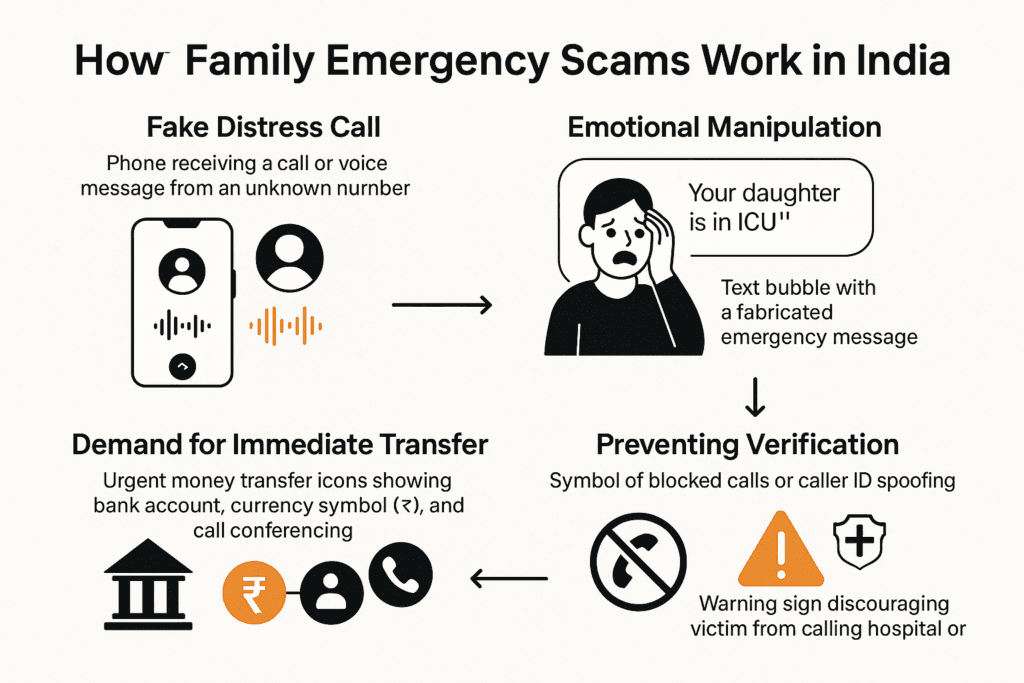

How Family Emergency Scams Work?

A Family Emergency Scam preys on emotional vulnerability. Scammers claim that a close relative (e.g., parent, child, sibling) has met with an accident, has been hospitalized, or is in police custody, and urgently needs money. The execution typically follows:

- Fake Distress Call

- The victim receives a call (sometimes a voice message) from an “unknown” number.

- The caller pretends to be a friend of the family member in trouble or, in more advanced cases, manipulates Social Media profiles to mimic the relative’s voice (voice-cloning).

- Emotional Manipulation

- The caller cries or sounds panicked, recounting a fabricated scenario: “Your daughter has been in a bike accident and is in ICU.”

- They claim that hospital bills or legal charges must be settled immediately.

- Demand for Immediate Transfer

- Urgent instructions: “Transfer ₹75,000 to this bank account, or she’ll be discharged.”

- The scammer may switch to call conferencing: “I’m the doctor; we need ₹1,00,000 for surgery, or she won’t make it.”

- Preventing Verification

- They discourage the victim from calling the “hospital” or “police station”: “If you call them, the case will be delayed.”

- In advanced scams, they redirect or block incoming calls from known numbers (caller ID spoofing or call flooding).

Read More: Cybercrime in India (2024–2025): Why You Should Pay Attention Right Now

External Reference: See National Cyber Security Coordinator: Common Scams in India for official advisories.

How does Voice Cloning Enable Family Scams?

Scammers use voice samples scraped from social media (as short as 3 seconds) to clone voices using AI tools. The cloned voice is then used in emotional pleas over phone or WhatsApp calls to demand urgent help or ransom.

Example: A mother receives a call from her “daughter” crying for help and asking for ₹3 lakh to avoid arrest.

Identifying Warning Signs

- No Verifiable Details: Vague about which hospital or police station the relative is in.

- High Pressure/Emotion: Continuous sobbing or aggressive urgency.

- Request to Keep Secret: Don’t tell any other family member, or it’ll be worse.

- Unusual Payment Methods: UPI to random IDs, gift cards, or cryptocurrency transfers.

- Mismatch in Story: The relative’s social media activity might contradict the emergency.

What Technology is used in Digital Arrest Scams?

Scammers use VoIP calls, Skype, WhatsApp, and AI-generated content including fake videos and voice modulation to mimic authority figures. They sometimes use pre-recorded clips, morphing apps, and deepfake video conferencing to appear convincing.

Why India is a Targeted Market?

High Mobile Penetration

- Smartphone Users: Over 750 million smartphones in use (Statista, 2025).

- Affordable Data Plans: 5G rollout and sub-₹10 per GB plans fuel mass connectivity.

- Result: Scammers have a broad base of potential victims with limited digital literacy.

Lack of Digital Awareness

- Digital Literacy Gap: Only 38% of urban households feel confident about digital transactions (IAMAI, 2024).

- Elderly Population: India’s 65+ age group often unfamiliar with emerging scam tactics.

- Rural Outreach: Scams spread through word-of-mouth in villages lacking formal channels.

Real-World Impact

| Scam Type | Total Loss (2024, Jan–Sept) | Notable Victims | Common Countries of Origin |

| Digital Arrest | ₹1,616 crore | Doctors, veterans, celebrities | Myanmar, Cambodia, Laos |

| Family Emergency | ₹1–5 lakh per case | Parents of students, seniors | India (calls from abroad) |

| All Cyber Scams | ₹11,333 crore+ | Across age groups | India + international rings |

Case examples

- A retired Navy officer lost ₹68.5 lakh to a digital arrest scam after being told his Aadhaar was linked to a drug bust.

- A Mumbai woman narrowly avoided loss after calling her daughter, who was safe, despite a cloned voice demanding money for accident treatment.

- A doctor was held under “video surveillance” for 7 days, coerced into transferring her family’s entire savings.

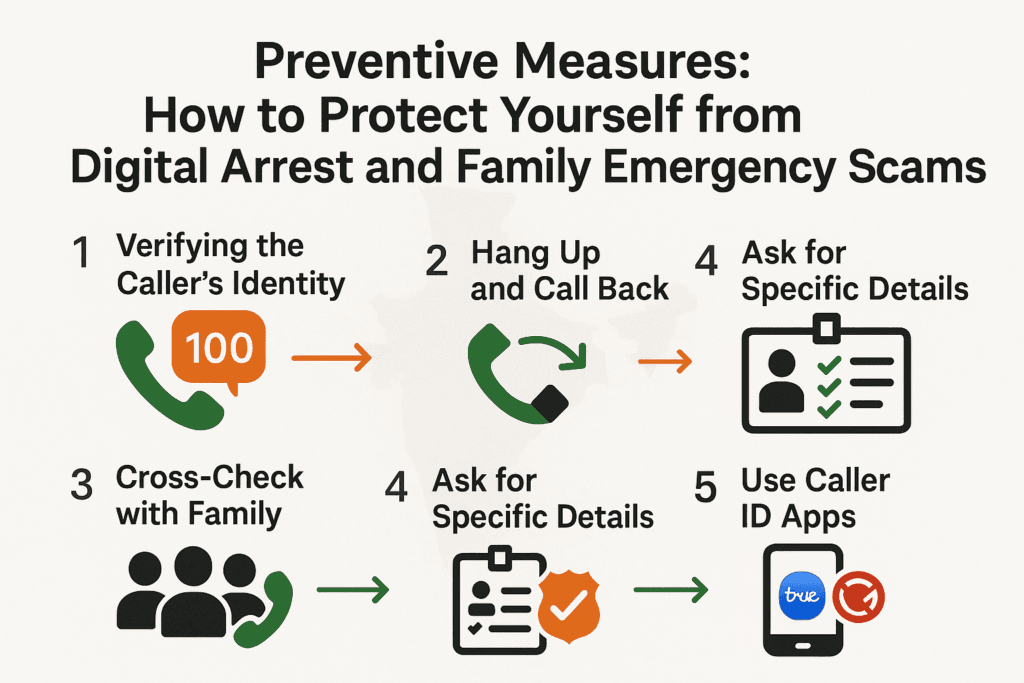

Preventive Measures: How to Protect Yourself

Verifying the Caller’s Identity

- Hang Up and Call Back

- Use the official police hotline number (e.g., 100 or your state’s police helpline).

- If claiming hospital custody, call the hospital’s public number listed online.

- Cross-Check with Family

- Immediately ring up the family member supposedly in distress.

- If unreachable, call their close friends or colleagues.

- Ask for Specific Details

- Request the caller’s badge number, name, and office extension.

- Verify by emailing or texting the relevant department.

- Genuine police will never ask for untraceable payments on the spot.

- Use Caller ID Apps

- Install apps like Truecaller to flag known scam numbers.

- Enable spam call protection on your smartphone.

Read Move: WhatsApp Scams in India: How They Work, How to Stay Safe, and What to Do If You Get Scammed

Secure Digital Practices

- Never Share OTPs or Bank Details: Banks and government agencies will never ask for OTPs, CVV, or PINs over the phone.

- Don’t Install Unverified Software: Remove AnyDesk, TeamViewer, or similar remote access apps unless you explicitly initiated a secure session.

- Update Software & OS Regularly: Keep your Android/iOS versions patched. Use official app stores (Google Play, Apple App Store).

- Use Multi-Factor Authentication (MFA): Enable MFA on your email, bank, and UPI apps to prevent unauthorized access.

What to Do When You’re Targeted

- Stay Calm: Scammers rely on panic. Take deep breaths before responding.

- Gather Information: Note down the caller’s phone number, time of call, and any badge/case numbers provided.

- Refuse Untraceable Payments: Politely decline and insist on an official notice via email or registered post.

- Report Immediately: File a complaint with the local police and register a case at the nearest cybercrime cell. Lodge a complaint on the National Cyber Crime Reporting Portal.

- Inform Family & Friends: Share the scam details to prevent knock-on fraud attempts.

- Monitor Your Bank Statements: Check for unauthorized debits; freeze affected accounts if necessary.

Reporting Scams: Legal and Regulatory Framework

Key Government Agencies

- Cyber Crime Police Station: Every state has designated cybercrime cells; locate yours via your state police website.

- National Cyber Crime Reporting Portal (NCCRP): Visit cybercrime.gov.in to file complaints online.

- CERT-IN (Computer Emergency Response Team – India): Issues advisories on new threats; subscribe to alerts at cert-in.org.in.

- Reserve Bank of India (RBI): For unauthorized UPI or bank transactions, raise a dispute with your bank under RBI guidelines.

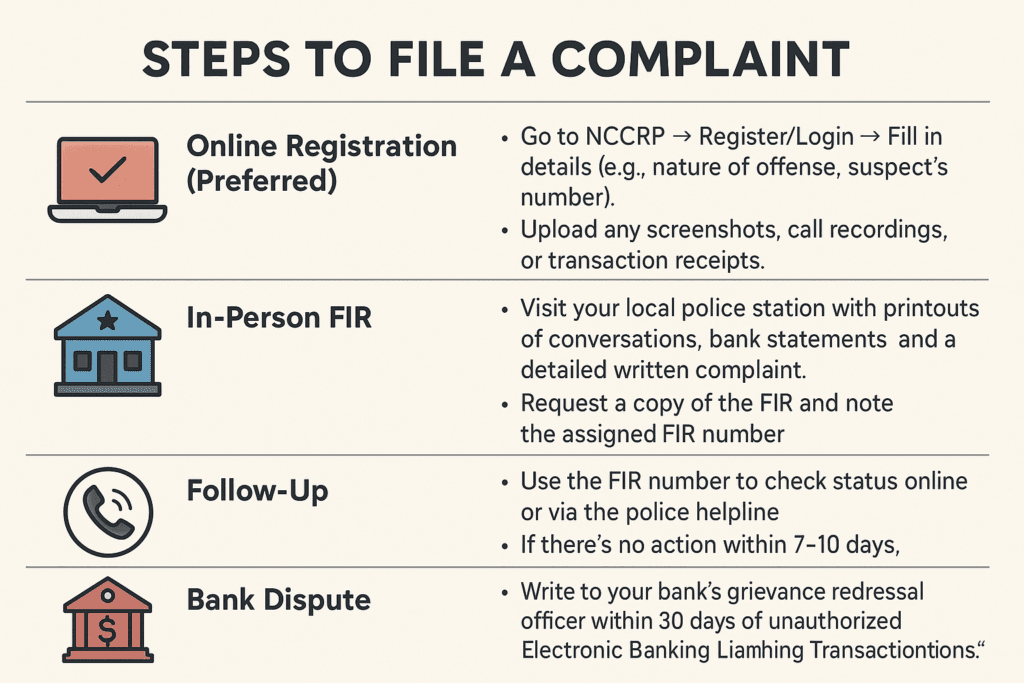

Steps to File a Complaint

- Online Registration (Preferred)

- Go to NCCRP → Register/Login → Fill in details (e.g., nature of offense, suspect’s number).

- Upload any screenshots, call recordings, or transaction receipts.

- In-Person FIR

- Visit your local police station with printouts of conversations, bank statements, and a detailed written complaint.

- Request a copy of the FIR and note the assigned FIR number.

- Follow-Up

- Use the FIR number to check status online or via the police helpline.

- If there’s no action within 7–10 days, escalate to the Superintendent of Police.

- Bank Dispute

- Write to your bank’s grievance redressal officer within 30 days of unauthorized transaction.

- Reference RBI’s circular on “Customer Protection – Limiting Liability of Customers in Unauthorized Electronic Banking Transactions.”

Resources & Further Reading

- Government & Law Enforcement

- Digital Safety Organizations

- Media Articles & Case Studies

- “How Digital Arrest Scams Affect Urban Seniors” – The Times of India, May 2025.

- “Family Emergency Fraud on the Rise During Festive Season” – The Hindu BusinessLine, March 2025.

- Helpful Tools

- Truecaller – Caller ID & spam blocking (Android/iOS).

- Google Authenticator – For MFA on UPI and email accounts.

- WhatsApp Two-Step Verification – Protects against account takeover.

Conclusion

Digital Arrest and Family Emergency scams in India have evolved in complexity and emotional manipulation. By understanding their mechanics, recognizing red flags, and employing robust preventive measures, you can significantly reduce your risk. Remember to:

- Stay vigilant—never act under panic.

- Verify any unexpected calls from “authorities” or “hospital staff.”

- Report suspicious activity immediately to relevant agencies.

Take Action Today: Share this guide with family and friends, especially elderly relatives who may be less aware of these tactics. Bookmark the National Cyber Crime Reporting Portal and save local police helpline numbers in your contacts. For regular updates, subscribe to CERT-IN advisories and follow official law enforcement social media channels.

FAQs for Digital Arrest Scams

1. What is a “digital arrest”?

A “digital arrest” is a fake concept used by scammers to extort money. It has no legal basis in Indian law.

2. Can police or CBI demand money on a call?

No. All payments, fines, or legal processes are conducted through formal written notices and court orders—not phone calls.

3. How can I report a cyber scam in India?

Visit https://cybercrime.gov.in or dial 1930, the official cyber fraud helpline.