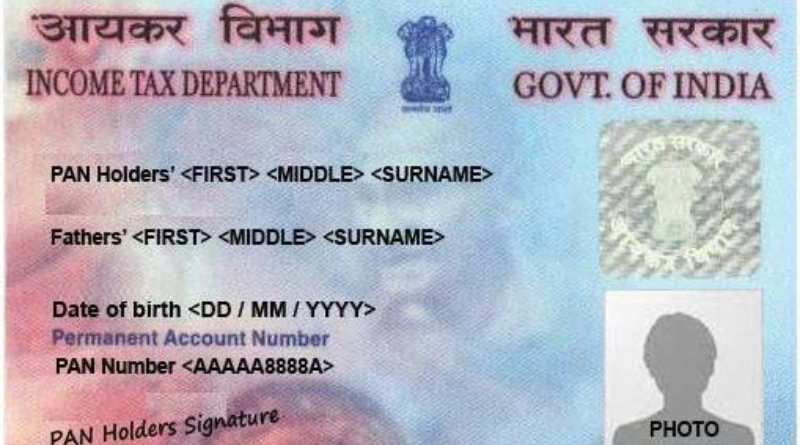

Back in 1994, the Income Tax Department of India created PAN to make tax stuff easier. It’s a special number that helps keep track of money moves, stops sneaky tax dodges, and makes tax checks and collections smoother.

The Code of PAN: 10 Letters and Numbers

PAN is a 10-character mix of letters and numbers, and each one has a job:

- First Five Characters: They show the person’s name, and the first letter says what type of taxpayer they are (A for people, C for companies, H for families, etc.).

- Fourth Character: This says if it’s an individual, a company, or something else.

- Sixth Character: An alphabet letter that double-checks if the PAN is real.

- Last Four Characters: Random numbers to make sure each PAN is unique.

Why PAN Matters: The Key to Money Moves

PAN is super important for money things in India:

- Tax Time: You need PAN to file income tax returns, so the tax folks know who’s who and what’s what.

- Bank Business: Most banks ask for PAN to open accounts, keeping things legit and stopping cheats.

- Investing Smarts: If you want to buy shares or mutual funds, you’ll need PAN for a clear record of your investments.

- Government Help: PAN is often needed for government services, like getting a passport or a tax deduction number.

Getting Your Own PAN: Easy Steps

Getting PAN is no big deal. Just follow these steps:

- Form Filling: Complete the PAN application form (Form 49A) with your details and give it to a special place, like an NSDL center or an authorized PAN agent.

- Document Time: Attach copies of ID proof (like Aadhaar card or passport) and address proof (like a utility bill).

- Pay Up: Pay the PAN application fee, which can change based on if you’re doing it online or in person.

- Wait for It: After checking your docs, they’ll send your PAN card to your address.

PAN: The Tax Boss of India

PAN is like the boss of taxes in India. It helps collect taxes, stops cheating, and keeps money matters open and clear for everyone. As India’s money scene grows, PAN stays important. It makes transactions smooth, keeps taxes in line, and adds to a money system that’s open and runs well. Knowing why PAN matters and getting one lets you be part of India’s money world.