What Is a Rug Pull Scam in Cryptocurrency?

What Are the Different Types of Rug Pull Scams?

Why Do Rug Pull Scams Happen in the Crypto Market?

6 Most Famous Rug Pull & Fake Crypto Scams

- OneCoin (2014–2017): The $4–15 Billion Deception

- Squid Game Token (2021): The Netflix-Inspired Nightmare

- AnubisDAO (2021): The 20-Hour Heist

- Mantra (OM) Token (2025): The Coordinated Collapse

- War on Rugs (2021): The Ultimate Betrayal

- Pig Butchering Scams: Emotional Manipulation for Billions

7 Ways to Identify a Rug Pull Before Investing

What Tools Can Help Detect Rug Pull Scams?

How Can You Stay Safe and Avoid Rug Pull Scams?

Introduction

The cryptocurrency market has experienced an explosive growth, with a projected market size reaching $5.43 billion by 2029 and over 962 million users expected by 2026. This rapid expansion has offered unparalleled opportunities, but it has also created a fertile ground for sophisticated scams that have cost investors over $101 billion in losses from 2014 to 2025. In 2025 alone, crypto crimes surged to $6 billion in losses, representing a staggering 6,500% increase from the previous year.

Imagine waking up to find your entire investment vanish in minutes, with the project developers disappearing without a trace. This isn’t a nightmare; it’s the harsh reality of a rug pull, a devastating type of crypto fraud.

These scams have become so prevalent that 98.6% of tokens launched on popular platforms are rug pulls or fraud schemes. This guide will explain what rug pulls are, why they happen, highlight infamous examples, and provide practical tips to help you protect your investments in the volatile crypto world.

What Is a Rug Pull Scam in Cryptocurrency?

A rug pull is a malicious operation in the cryptocurrency industry where developers of a new project suddenly abandon it, taking investors’ funds with them. The name vividly describes the act: like someone “pulling the rug out from under everyone’s feet,” leaving investors with worthless tokens.

This form of fraud can range from simple liquidity theft to complex schemes involving hidden code and psychological manipulation.

What Are the Different Types of Rug Pull Scams?

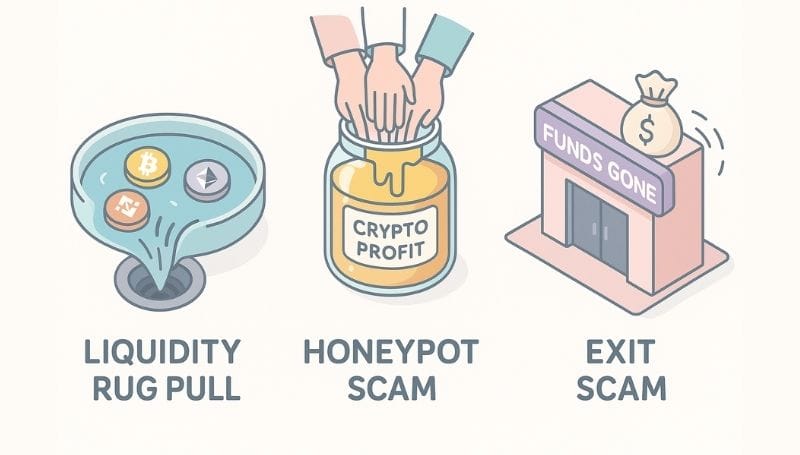

Rug pulls manifest in various forms, each with its own mechanism of deception:

- Liquidity Rug Pull: This is the most common type. Developers create a new token and pair it with a popular, valuable cryptocurrency (like Ethereum or BNB) in a decentralized exchange (DEX) liquidity pool. Investors buy the new token, adding more funds to the pool. Once sufficient funds are accumulated, the developers abruptly remove all the valuable cryptocurrency from the pool, causing the new token’s price to crash to zero and leaving investors with unsellable, worthless assets.

- Honeypot Scam: In a honeypot, the smart contract for the token is specifically coded with a hidden mechanism that prevents investors from selling their tokens, while the developers are free to sell theirs at any time. This traps investors, allowing the developers to pump the price before cashing out, leaving others unable to exit before the inevitable crash. The notorious Squid Game token used this exact method.

- Exit Scam: This is a broader term where the founders of an entire project, which could be a cryptocurrency exchange, a DeFi lending platform, or an initial coin offering (ICO), suddenly shut down operations and disappear with all user funds. The Turkish exchange Thodex, for example, notoriously stole $2 billion this way.

Why Do Rug Pull Scams Happen in the Crypto Market?

Several underlying factors contribute to the rampant occurrence of rug pulls in the cryptocurrency ecosystem:

- Lack of Regulation: The crypto space operates with minimal governmental oversight, making it a high-risk environment.

- Anonymous Developers: Many crypto projects are launched by pseudonymous or completely anonymous teams who hide behind online aliases.

- FOMO (Fear Of Missing Out): Scammers exploit impulsive investing behavior and hype-driven culture to attract victims.

- Technical Complexity: Many everyday investors lack the technical knowledge to audit code or verify liquidity locks.

6 Most Famous Rug Pull & Fake Crypto Scams

The cryptocurrency industry, while full of innovation and opportunity, has also seen some of the most devastating scams in financial history. Rug pulls and fake projects have collectively stolen billions of dollars, leaving investors empty-handed. Below are some of the most notorious examples:

1. OneCoin (2014–2017): The $4–15 Billion Deception

OneCoin promised to be the next big thing in crypto, branding itself as the “Bitcoin killer.” In reality, it wasn’t even a real cryptocurrency, it had no blockchain. Instead, it used a centralized database to fake transactions. The scam was run as a multi-level marketing scheme, tricking millions of people worldwide.

- Amount stolen: Estimated between $4 billion and $15 billion.

- How they fooled investors: They organized massive conferences, created glossy marketing materials, and leveraged charismatic leaders like Ruja Ignatova (“Cryptoqueen”), who disappeared in 2017 and remains wanted by the FBI.

2. Squid Game Token (2021): The Netflix-Inspired Nightmare

This scam took advantage of the global popularity of Netflix’s Squid Game. The token price skyrocketed by more than 40,000%, hitting $2,861 per token before collapsing to almost zero. Why? The smart contract was coded so that investors couldn’t sell their tokens, while the developers cashed out freely.

- Amount stolen: Around $3.3 million.

- How they fooled investors: Clever marketing, a professional-looking website, and leveraging cultural hype.

3. AnubisDAO (2021): The 20-Hour Heist

AnubisDAO raised a massive 13,700 ETH (around $60 million) in under 24 hours, only for the funds to vanish the next day. There was no product, no roadmap just hype and borrowed branding from successful projects like OlympusDAO.

- Amount stolen: Around $60 million.

- How they fooled investors: Using crypto Twitter buzz and influencer shills to create FOMO.

4. Mantra (OM) Token (2025): The Coordinated Collapse

One of the largest rug pulls in recent years, Mantra positioned itself as a real-world asset DeFi platform. Suddenly, 17 wallets dumped 43.6 million OM tokens, causing the price to crash by 94%, wiping out billions in value.

- Amount lost: Over $227 million directly; $5.52 billion market cap evaporated.

- How they fooled investors: By appearing legitimate and leveraging a strong community presence, proving that even established-looking projects can be scams.

5. War on Rugs (2021): The Ultimate Betrayal

War on Rugs was supposed to protect people from scams. Instead, its founder “Shappy” launched his own tokens (Fairmoon and RETH) and scammed his followers, exploiting trust within an anti-scam community.

- Amount stolen: Over $2 million.

- How they fooled investors: By gaining trust as a watchdog and then exploiting that authority.

6. Pig Butchering Scams: Emotional Manipulation for Billions

Unlike fast rug pulls, pig butchering scams are long-term cons where scammers build emotional relationships with victims over weeks or months (often via dating apps). Once trust is built, they lure victims into fake crypto platforms, showing fake profits, and then steal everything.

- Amount stolen: Over $2.5 billion in 2024 alone, according to regulators.

- How they fooled investors: By creating emotional dependency and fake “investment opportunities” that seemed safe and profitable.

7 Ways to Identify a Rug Pull Before Investing

Prevention is better than cure, and spotting red flags early can save you from losing money. Here’s what to look for:

- Anonymous or Unverifiable Team: If the team hides behind fake names or avatars and has no verifiable social profiles (like LinkedIn), it’s a huge warning sign. Legitimate projects are transparent about their founders.

- No Smart Contract Audit: A reputable project will undergo a professional security audit from firms like CertiK or PeckShield. No audit = high risk of malicious code.

- Liquidity Not Locked: In DeFi, liquidity pools should be locked for months or years using services like Unicrypt. If not, developers can pull all the funds instantly.

- Unrealistic Promises of Returns: If a project claims “1000x profits” or guaranteed returns, it’s a scam. Crypto is highly volatile—nobody can guarantee fixed profits.

- Hype Over Substance / Rushed Launches: Projects focusing only on marketing, Twitter hype, influencers, countdowns without a clear roadmap or working product are likely scams.

- Concentrated Ownership: If a few wallets hold 30–40% of tokens, they can dump anytime and crash the price. Check token distribution on Etherscan or BscScan.

- Complex or Unexplainable Mechanisms: If the project uses overly technical jargon and you can’t understand how it works, stay away. Complexity often hides fraud.

What Tools Can Help Detect Rug Pull Scams?

Before investing, use these free tools to check a project’s health:

- TokenSniffer: Scans smart contracts for suspicious features like honeypots or hidden minting.

- BSC Check / De.fi Scanner: Offers security ratings and liquidity lock status.

- Honeypot.is: Tests if you can actually sell the token.

- RPHunter: Uses advanced analysis to detect malicious transaction patterns.

How Can You Stay Safe and Avoid Rug Pull Scams?

Individual Investor Strategies

- Do Your Own Research (DYOR): Never invest based on hype alone. Read the whitepaper, check the roadmap, and verify claims.

- Verify Team Identities: Check LinkedIn, GitHub, and social presence.

- Check Liquidity Locks and Tokenomics: Make sure liquidity is locked and token distribution is fair.

- Avoid Hype and FOMO: Scammers thrive on urgency and hype.

- Use Reputable Platforms: Stick to major exchanges like Binance or Coinbase.

- Limit High-Risk Investments: Never invest more than you can afford to lose.

- Test with Small Amounts: Before big investments, try buying and selling a small amount to check if the token works.

Platform-Level Solutions

- Strict Listing Standards: Exchanges should verify teams and audit reports.

- Smart Contract Monitoring: Use automated tools to detect suspicious movements.

Conclusion: What’s the Best Way to Protect Yourself From Rug Pulls?

The crypto market will keep growing, but scams will evolve too. The best defense is knowledge and vigilance. Always verify the team, check for audits, use detection tools, and never fall for unrealistic promises.

Golden Rule: If it sounds too good to be true, it probably is.

Key Takeaways

- Rug pulls and fake projects have stolen billions from investors.

- Always check for team transparency, audits, and liquidity locks.

- Use tools like TokenSniffer and Honeypot.is to detect risks.

- Avoid hype-driven investments and never risk more than you can lose.

- Knowledge is your best protection in the crypto space.

FAQs for Rug Pull Scams

1. Can rug pull scams happen on centralized exchanges?

Yes. Although rug pulls are mostly associated with decentralized finance (DeFi), centralized exchanges (CEXs) can also be involved. This happens when an exchange lists unverified tokens or, in rare cases, performs an exit scam by shutting down and disappearing with user funds. Always stick to well-known, regulated exchanges.

2. What is the difference between a rug pull and a pump-and-dump scam?

A rug pull occurs when developers abandon a project and drain liquidity, leaving investors with worthless tokens. A pump-and-dump scam is when influencers or insiders artificially inflate the token price and sell at the peak, causing a rapid price crash. Both are fraudulent, but rug pulls involve liquidity theft, whereas pump-and-dump relies on market manipulation.

3. Do smart contract audits completely prevent rug pulls?

No. While audits from firms like CertiK or PeckShield reduce risk, they cannot guarantee safety. Developers can still scam investors later by migrating liquidity or deploying a new contract. Always check for locked liquidity and developer credibility in addition to audits.

4. Are NFTs and metaverse projects also at risk of rug pulls?

Absolutely. Many NFT projects and metaverse initiatives have been abandoned after raising millions. Scammers launch collections, promise future utilities or games, and then disappear without delivering. Always verify the team, roadmap, and smart contract details before investing in NFTs or virtual land.

5. What legal action can be taken if you fall victim to a rug pull?

Legal recourse is difficult because most scams involve anonymous developers and cross-border jurisdictions. However, victims can:

- Report to regulators like the SEC, FCA, or local cybercrime units

- File complaints on IC3.gov or Europol

- Join community-led lawsuits or recovery efforts

Keep in mind that the success rate of recovery is very low.